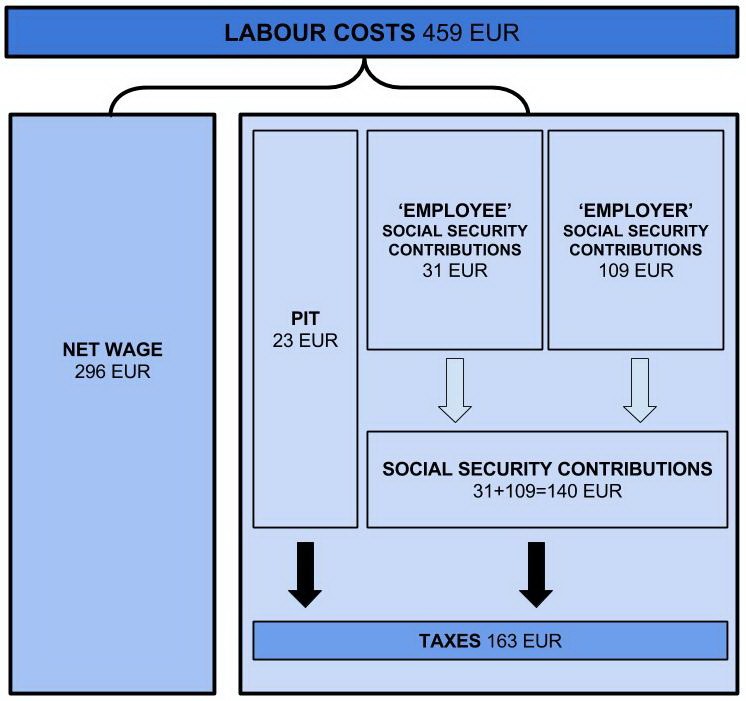

The Lithuanian Free Market Institute (LFMI) has designed a model for merging the so-called employer social security contributions with the so-called employee social security contributions. In Lithuania, the former account for 30.98% and the latter for 9% of gross salary, adding up to 39.98% paid directly by the employer.

LFMI argues that although transferred by the employer, social security contributions are in fact paid by the employee. First, the employee is the one to receive the benefits of social security. Second, when hiring personnel, the employer evaluates all employment-related costs, including salary and so-called employer taxes.

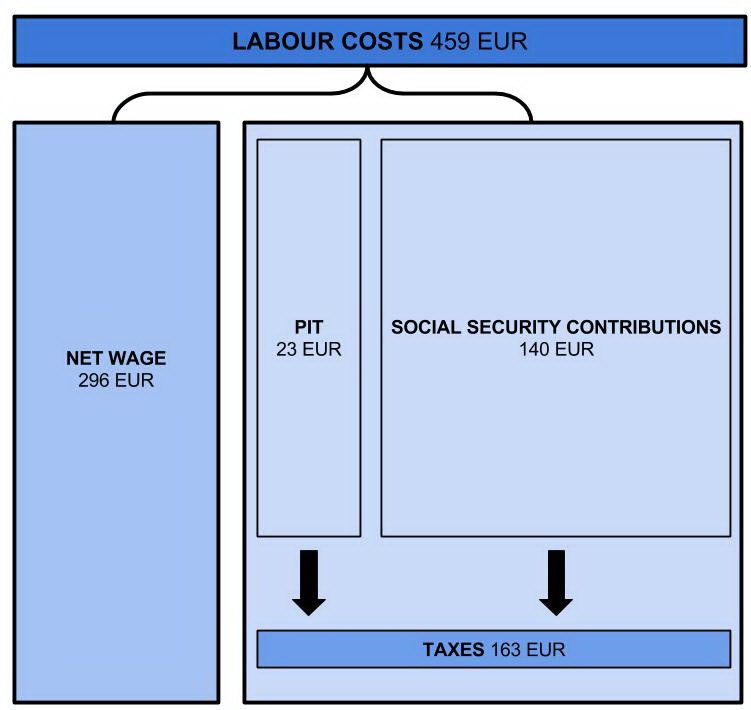

Under the current system, 30.98% of gross salary is mostly invisible to the employees. If social security contributions were merged, the Lithuanian tax system would become simpler, fairer, and more attractive to foreign investors. In addition, the unification of the tax base for social security contributions would help fight the shadow economy as taxpayers will see a clear link between their contributions and the benefits of social security.

Under LFMI’s model, gross salary would increase by 30.98 percent while net earnings would stay the same. The difference between gross and net income will reflect the actual amount of tax paid by the employee. Therefore, the proposal is fiscally neutral.

You may read the full policy brief On the Unification of the Tax Base for Social Security Contributions (in Lithuanian) here.

1. Current situation

2. Situation after merging social security contributions