4liberty.eu Network

Executive Summary

The European Commission has launched a legislative initiative on an EU framework for markets in crypto-assets. The following presents a position on the proposed legislative initiative and sets forth arguments against a straightforward application of the legacy directives regulating FinTech or financial markets to crypto-assets. It is advisable that the crypto-asset sector should be allowed to evolve first, while the European Commission should provide a classification of crypto assets that would build upon already established typologies as a EU-wide non-legislative guidance.

1. Decentralized Finance as a Valuable Insurance

Crypto-assets and network that generates them introduce new solutions to old finance problems. Eleven years after the creation of Bitcoin we are still at the beginning as the sector explores the innovation frontier for problems it can solve with new technology – small and fast payments, smart contracts, insurance, decentralized lending, crowdfunding, prediction markets just to name few. This new players have the competitive potential to force the traditional financial institutions into needed changes. Gigantic banks of the size of whole member state economies and heavy reliance of the corporate sector on bank financing in Europe proved to be a problem in the last financial crisis. Crypto-sector opens an opportunity to develop a parallel systems that would enhance the digital operational resilience of the financial system and provide an insurance against failures. Furthermore, the vast majority of applications within the field of Decentralized Finance (DeFi) operate in the form of open-source algorithms deployed on distributed blockchain systems and significantly lower the barriers of entry to the global financial markets for the unbanked population. Moreover, as these applications are mostly designed in a non-custodial fashion and utilize smart contracts they largely eliminate the counter-party risks related to financial transactions. Therefore, Crypto-assets are more of an opportunity, than a threat, since they provide the market with a healthy competition which poses less systemic risk, since it is based on a decentralized technology.

2. Tokenization

Another use of the decentralized ledger technology (DLT) is tokenization of all kinds of assets including real estate, art or luxury items. Tokenization, when complemented by sensible and flexible regulation, offers multiple benefits whereas one of the key ones is making these items more accessible to retail investors, as they are able to invest only in a fraction of such items. Furthermore, using DLT results in disintermediation of the role of central authorities and book-keepers which often represent a single point of failure.

Furthermore, tokenized assets may be more liquid, and along with the higher accessibility may allow for increased demand and appetite from the retail investors. Such a thing is desirable especially given the state of the investment culture in Europe, compared to the US or many Asian countries.

But it is important to note that tokenization alone won’t be able to reach its full potential if the regulators will introduce obstacles in the form of extensive administration, reporting, and disclosure duties. In order to maximize the positive effects of this trend the regulatory approach should aim to provide as much freedom and flexibility as possible. Strict regulations related to issuance of crypto assets significantly hinder innovation in the crypto-assets space, and thus shift the economic activity outside of Europe.

3. A Framework and Regulatory Clarity are Needed

Crypto-assets present an opportunity for deepening the Single Market for digital financial services and promoting a data-driven financial sector. Because of the various treatments of the crypto-assets between member states there is a very high uncertainty in the sector on how to progress and develop business in accordance with the laws in EU wide terms. This increases the costs of doing crypto business in EU and deters further investment.

Therefore one of the most important activity that European Commission should focus on is to actively support cross-national sharing of the best practices amongst the regulators, from the member countries, when it comes to the issue of crypto-asset treatment. Harmonization should be considered in the case of treatment of security tokens and their disclosure/reporting requirements in order to allow issuing them across the whole EU, from within the member countries.

4. Guide – Do not Stifle

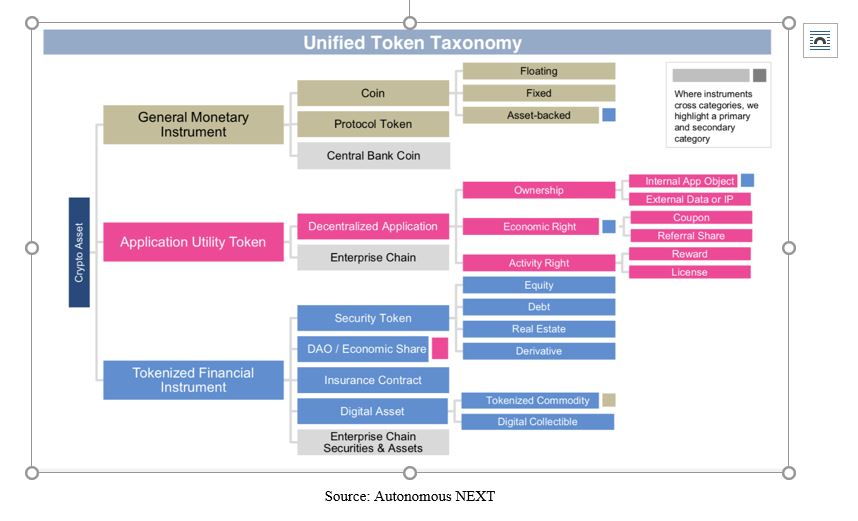

We do recommend to propose a EU-wide non-legislative guidance – classification of crypto assets that would build upon already evolved/established typologies. The main purpose of such a classification should be to distinguish features of the crypto-assets and to draw a line between those assets that fall into the category of security tokens and the rest.

While some crypto assets may consist of hybrid characteristics we suggest to categorize them based on their primary, and usually intended, feature. As per the graph above, we propose a light-weight regulatory approach to the first two categories of General Monetary Instruments and Application Utility Tokens. While Tokenized Financial Instruments may raise concerns related to protection of the retail investors/consumers, it is important to point out that due to the completely transparent nature of the underlying system these assets operate upon certain risks related to the legacy financial instruments are mitigated.

Crypto and token friendly, and flexible regulation is a great opportunity for the EU to boost innovation and increase efficiency of the market mechanism. While the classification of the asset should be a non-legislative act, it might be reasonable to introduce definition of security tokens especially for the purpose of tokenization of the companies’ shares and stocks. We do recommend to exclude tokens backed by assets such as real estates, commodities or other kinds goods from definition of security tokens in order to foster innovative potential of the emerging business models related to tokenization.

It is important to consider also options to create a regulatory sandbox that would provide guidance to innovative start-ups and projects implementing crypto assets and DLT.

Furthermore, if the legislative path is taken, as per the security tokens we do recommend to define categories in which projects will be allowed to pursue more flexible and light-weight regulatory regime when it comes reporting and disclosure obligations. These criteria might be based on the amount raised by the particular projects as it is common in crowd-funding regulations. Issuers of security tokens, raising above a certain level, could be subjected to higher regulatory scrutiny and reporting as well as disclosure standards. At the same time security tokens might be appearing increasingly more in the future and could help with fundraising for SMEs, and therefore, their regulations should be flexible enough to be useful for SMEs. Rigid rules and regulatory heavy obligations may hinder or possibly even dwarf competition in the space.

5. Educate

Prevention of various risks related to crypto-assets (fraudulent activities, price/volume manipulation, investing risks, personal data risks, cyber security and operational risks) lies partly in better education of the public. It is highly desirable to support educational and awareness activities in this area in order to bridge the gap between the stake holders from various spheres such as academia, developers, private companies and the public sector. This does not need to be done necessarily through creation of new institutions or increased public spending, but the support should go to already established actors and private and public education organizations in the member countries.

6. Observe the Evolutionary Growth, Step In and Legislate with Care Later

We do not recommend to apply the legacy directives to FinTech or financial markets directly in a straight-forward fashion to crypto-assets. Since crypto assets are still in the nascent phase and are significantly smaller in terms of the market capitalization compared to other financial assets, commodities and derivatives markets.

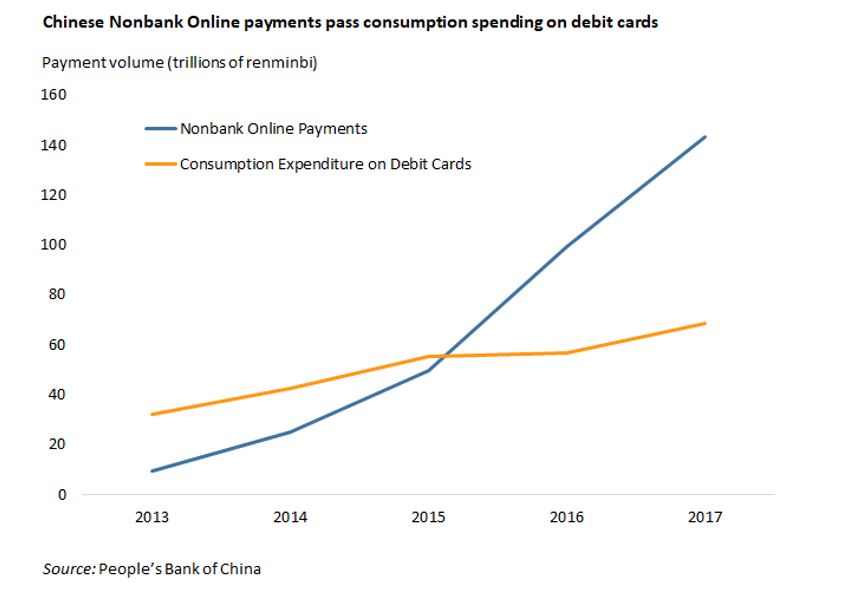

There is a case study in the “first let evolve, learn and then regulate” approach. China became dominant world force in FinTech precisely this way. In the year 2018 half of the retail expenditures were made on the mobile phone (2.9 trillion) outside of traditional banking system.[1] The mobile payments in the US are approximately 30 times smaller for the same period.[2]

“China’s central bank waited years before passing official regulation of the sector in 2010 and issuing licenses soon after, which allowed the market to develop largely free of compliance costs, entry barriers, and regulatory restrictions. In the United States, by contrast, companies like PayPal had to go through an inefficient, fragmented state-by-state process to obtain money transmitter licenses. Nonbank online payment systems like Alipay were thus almost a decade old when regulations came into play; by that time, they had reached critical mass thanks to network effects and the hundreds of millions of Chinese using smartphones, driving a shift from online to mobile payments” [3]

Source: Peterson Institute for International Economics (PIIE)[4]

Sure, there are risks involved in letting crypto-assets evolve in more flexible regulatory environment but one has to keep the risks in perspective. Flexible regulatory environment does not mean a total absence of rules of conduct. Businesses in crypto-assets have to abide by the general law (e.g. protection of property rights, anti-fraud) which is applicable to all businesses. Also, they have a big incentive to create internal and voluntary codes of conduct to increase trust. Moreover, potential losses and the impact on the stability of the financial sector are still negligible. Purchase transactions of goods or services with settlement in crypto-assets in Europe are estimated to be insignificant [5] and the ECB Crypto-Assets Task Force analysis concludes “that crypto-assets do not currently pose an immediate threat to the financial stability of the euro area. Their combined value is small relative to the financial system, and their linkages with the financial sector are still limited. There are no indications so far that banks in the EU have systemically-relevant holdings of crypto-assets.”[6]

We shouldn’t forget, that the heavily regulated traditional banks were and still are the bigger problem. The financial needs for government bailouts in the euro area are estimated at 5.1% of GDP for the period 2008-2013.[7] 693 billion 2013 euros is in today’s terms still multiple times the current market capitalization of the whole crypto-assets sector. [8]

7. Conclusion

Crypto-assets and network that generates them introduce new solutions to old finance problems. The crypto-sector opens an opportunity to develop a parallel system that would enhance the digital operational resilience of the financial system and provide insurance against failures. Crypto-assets enable deepening the Single Market for digital financial services and promoting a data-driven financial sector. Because of the various treatments of the crypto-assets between member states there is very high uncertainty in the sector on how to progress and develop business in accordance with the laws in EU wide terms. Therefore one of the most important activity that the European Commission should focus on is to actively support cross-national sharing of the best practices amongst the regulators, from the member countries, when it comes to the issue of crypto-asset treatment. Harmonization should be considered in the case of treatment of security tokens and their disclosure/reporting requirements in order to allow issuing them across the whole EU, from within the member countries. We do recommend that the EC provides a EU-wide non-legislative guidance – classification of crypto assets that would build upon already evolved/established typologies. We do not recommend applying the legacy directives to FinTech or financial markets directly in a straight-forward fashion to crypto-assets. Since crypto assets are still in the nascent phase and are significantly smaller in terms of the market capitalization compared to other financial assets, commodities and derivatives markets, we strongly suggest a “first let evolve, learn and then regulate” approach.

[1] https://www.bloomberg.com/graphics/2018-payment-systems-china-usa/

[2] https://www.statista.com/statistics/312492/mobile-payments-in-the-united-states-by-segment/

[3] https://www.piie.com/blogs/china-economic-watch/how-china-leapfrogged-ahead-united-states-fintech-race

[4] https://www.piie.com/blogs/china-economic-watch/how-china-leapfrogged-ahead-united-states-fintech-race

[5] https://www.ecb.europa.eu/pub/economic-bulletin/articles/2019/html/ecb.ebart201905_03~c83aeaa44c.en.html#toc5

[6]https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op223~3ce14e986c.en.pdf?f2e9a2596a8f9c38c95f4735c05a0d47

[7] https://www.ecb.europa.eu/pub/pdf/scpsps/ecbsp7.en.pdf

[8] https://coinmarketcap.com/